Why choose Harborstone?

When you choose Harborstone, you choose relationships. See how we partner with you to earn your trust and help you make informed decisions.

Member Stories

The person that helped me was informative and very patient. She got me all set up and have a plan to work on building my credit score so I can achieve my dream of buying a house. I am so thankful for Harborstone!

Patty H.

Chantel at Harborstone gave me best practices for my loan, future loans, and how to get myself some of the best offers they have. She used extremely consumer-friendly language, and overall eased my anxiety.

Joey M.

The greatest staff. All of them. It is so nice to have someone you can rely on, who is positive, patient, kind and personable as well. Best banking experience ever!

Callie C.

Here to serve you.

Safety & Security

Helpful Resources

Our Partnerships

We value our ongoing partnership with Junior Achievement of Washington, and our shared mission of achieving financial empowerment for today’s youth.

Our Communities

We believe in the boots-on-the-ground approach of showing up and serving our communities. See where we’re showing up, and figure out how you can join us.

Our Blog

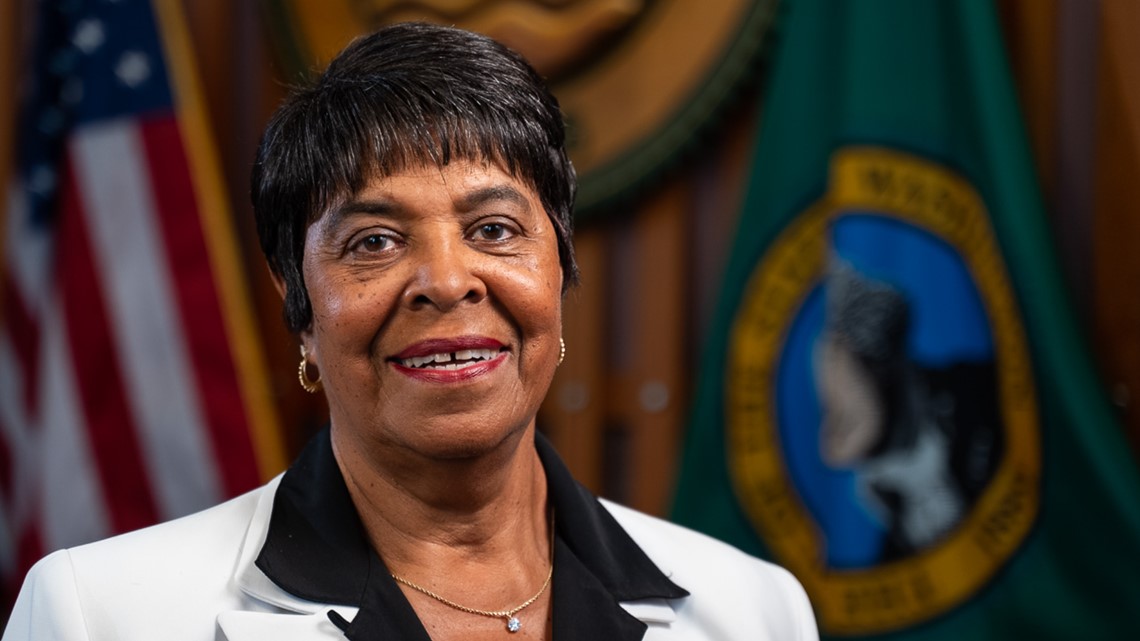

Former Harborstone employee of 36 years and current Deputy Mayor of Lakewood, Mary Moss is leading the way for change, fighting inequality and injustice in our community.

Your Harborstone

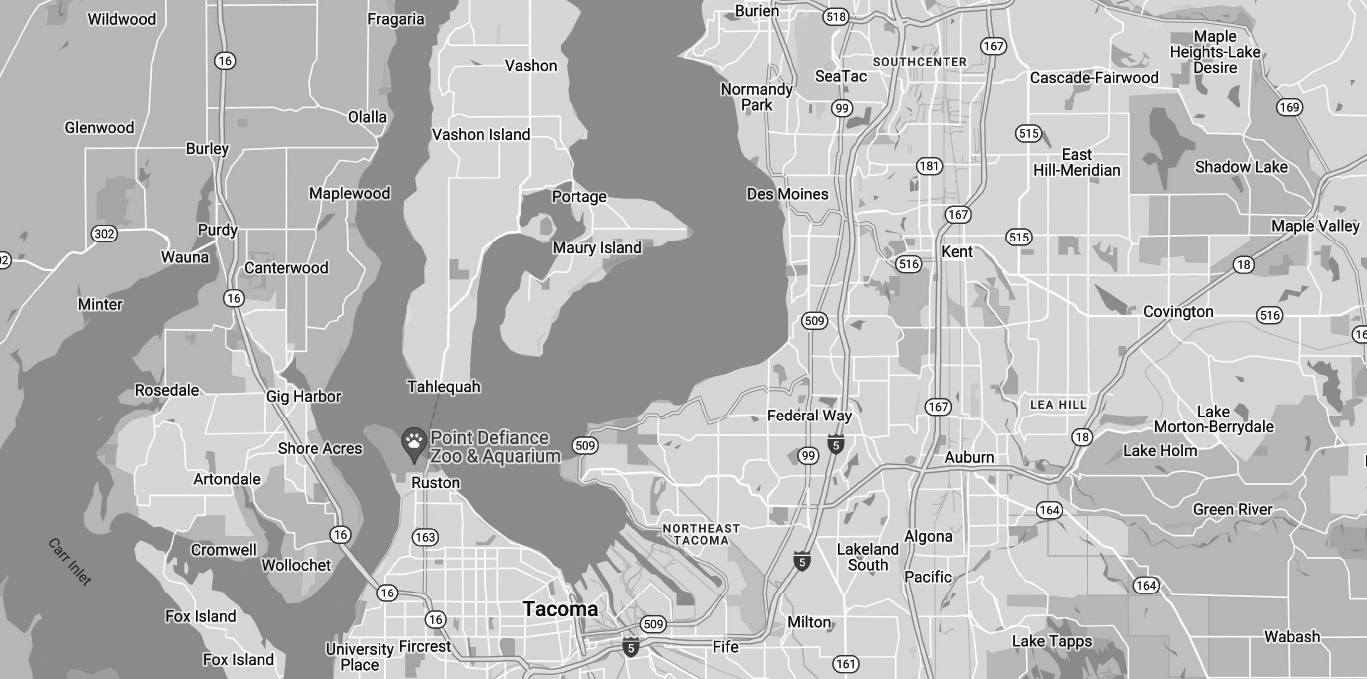

Find your local community.

Select your branch community to find local resources and events near you.

Hello, 74th Street, Tacoma

As the manager of the 74th Street branch I treat everyone as they deserve to be treated, with dignity and respect. I bring my full self to work and being vulnerable and transparent. My team supplies this branch with such hard work day-in and day-out, I feel it is my ongoing endeavor to provide them the tools and support necessary to flourish in their roles and fulfill their career path aspirations- both inside and outside this branch. I stand up for our Tacoma Community and support them when they are experiencing their most challenging moments. My role is to offer a helping hand by offering support and employees, while spreading the word of trusted relationships outside of Harborstone Credit Union to extend our reach of assistance.

Hello, Bonney Lake

Since 2001 Harborstone has had the pleasure of being a part of the Bonney Lake scene. I enjoy being immersed in a community with family-friendly and active opportunities to interact. I’m here to serve our neighbors and support their financial journey as Bonney Lake continues to grow in size and flourish.

Hello, Bothell

The Bothell team at Harborstone Credit Union believes we make a difference in the way we care. Being involved and present in the community of Bothell and surrounding area, let’s us connect with our members in a way that allows us to better understand and serve their needs.

Hello, Center Street, Tacoma

I am thankful for being active in community service to meet our community members in a genuine environment. There is a special connection we get to make with each other when we remove ourselves from work or daily environments to share our hearts towards a selfless need. I have gotten to meet so many great people and learn what they are doing daily to better our community. I promise to be more committed every day just like the people I meet.

Hello, Federal Way

We strive to serve our past, present, and future members in the greater Federal Way community by providing the tools and resources to promote financial empowerment and increase financial literacy!

Hello, Gig Harbor

Harborstone Credit Union has been a part of the Gig Harbor community since 2004. For years we have made it our mission to serve the community through active involvement in organizations and events such as the Young Professionals, Relay for Life, and the Maritime Festival. Our staff sits on the board for the Chamber of Commerce and participates in their many activities to help the community thrive. We also provide donations and education to support our youth through Food Backpacks 4 Kids and teaching financial education at schools in the area. The Gig Harbor team is made up of local people who support the community and love to see it prosper not only because we care, but because we are personally impacted by the success of those around us.

Hello, Hawks Prairie, Lacey

Harborstone has been a second home for me, since I started in 2019. Not only does Harborstone care deeply about their members, they also care deeply about their employees. Of the many opportunities that I have earned while at the Credit Union, leading the Hawks Prairie team is one that I take much pride in! One of my missions as the branch manager of the Hawks Prairie location is to help everyone feel a piece of home while they are here.

Hello, Issaquah

The best part of being the branch manager of the Issaquah location is the opportunity to meet people, make friends, and working together to help our community thrive economically, promoting values, and diversity throughout the city.

Hello, Kent Station

Lifestyle Center located near the Sounder Station and an important connection point for King County Metro. Local shoppers and visitors who visits the Kent Station Business Center can access the Kent Branch to get support for their personal and business financial needs. A prong of stop where they can experience a financial coach to guide them reach their financial goals.

Hello, McChord

Harborstone Credit Union started on McChord with a group of airmen with a passion to help other airmen. To this day we have kept the same desire to help all service members and their families reach their financial goals and dreams. This is our way to give back to the military community in a meaningful way by guiding them through all milestones in their lifetime.

Hello, Puyallup, South Hill

What I love most about working for Harborstone, is that we are people, people. We truly care about every single member that we have an interaction with, whether they are walking through our front door, calling in or stopping by in the drive up. On the good days and the bad, we want to show up and help in any way that we possibly can. Harborstone closely works with its employees by bringing their ideas and creativity to life; and because of that we are able to help and give back to our community in so many unique ways

Hello, Seattle

I am proud to be part of a team that is committed to helping members build financial security; providing a peace of mind, where they are no longer worried about having enough money to cover expenses.

Hello, Spanaway

Spanaway is a team of individuals with different life experiences! We understand the challenges life can bring and are able to assist our membership with navigating around those tough times. Our team diversity is a huge strength of our branch and allows us to connect with individuals from all walks of life. Harborstone is a core staple in the Spanaway community, not only do we have the opportunity to learn and discuss what your specific financial goals and needs are, but we also strive to provide you the tools in creating your financial empowerment, and as a result, helping create a thriving community. We are passionate about creating and maintaining generational wealth by being a part of our members’ life journey and supporting them through all situations.

Hello, Tukwila

I love being able to provide the members of our Tukwila community consistent, friendly, and quality service. I enjoy working together with my team to help both new and our long-standing members achieve their financial stability; whether it be taking first steps towards good credit, gaining financial independence, or growing their current finances for a better future.

Who can be a Harborstone member?

Click the piggy bank to find out...